The 16th edition of "E-commerce in Italy" was held on May 5th, 2022.

The E-commerce in Italy 2022 report - with the participation of best e-commerce italian companies - covers innovations, trends, best case studies and market's evolutions after the Covid-19.

You can read the 2021 Report here.

Download the research

DownloadNew Italian customers – more than 3 and a half million – who have started to access the internet in the last two years thanks to the lockdowns, have begun to show their effects on turnover which has grown by 33% in just one year, reaching over 64 billion euros in 2021. The main problem is still that in Italy there is still not enough investment in e-commerce.

However, the digital channel makes up 17% of retail sales. This is why, on the one hand, thousands of Italian stores in 2021 have closed down and, on the other, foreign operators, who are expanding into the Italian market, are taking advantage of this new channel.

European countries have started to protect the internal market with privacy violation fines and by taking dominant positions against the big international giants. At the same time, they have simplified trade on the European continent by greatly simplifying VAT management with the One-Stop-Shop.

Thanks also to these simplifications, today more than half of Italian e-commerce operators sell in foreign markets with a 32% turnover, obtained mainly from French, Spanish, German and English customers.

From a business model point of view, the considerable increase in turnover is pushing the companies with better infrastructures to be chosen for the service and on the other side, there are companies with product control who want to have direct contact with the customer. This is why marketplaces consolidate at the top of the Top 100 Italian e-commerce rankings, while manufacturers are starting to climb the rankings by actually pushing retailers to evolve their business model. For example, Decathlon, becoming a marketplace to be considered the entry point for those looking for sports equipment.

Whoever becomes an entry point on the internet for the research of products to buy has also an important second advantage: optimising advertisement investments. The high demand by customers during lockdown has significantly simplified marketing activity. However, at the end of lockdown, foreign operators have entered the field and again increased advertisement competition and therefore the complexity of marketing activities. In 2021, operators again had to find new ways to attract customers. One of these levers that, luckily, is proving to be important is the environmental sustainability of retail. Italy, more than other countries, has

customers with a strong awareness of this issue.

2022 will probably be a year of strong acceleration of e-commerce in some areas such as Tourism that, thanks to a probable reopening of many businesses, will be able to take advantage of millions of new customers online.

Regarding the online advertisement activities of one’s brand, Italian companies are struggling again after an easy year due to lockdown and the online demand for goods that exceeded supply. 32% of companies interviewed declared they were

satisfied and to have found the right path to promote their brand (-16% compared to last year). Online advertisement activity is still considered difficult by 55% of companies (+12% than last year). 14% declared the activity unsatisfactory, being unable to find a system with a good cost/result ratio.

After quite an easy year for acquiring new customers, the theme of advertising and marketing becomes central again. The average acquisition cost in Italy is 34.4 euros with great differences between sectors. Fashion, for example, is the most expensive business: 93 euros to get a new customer; while for Food only a 25 euros marketing investment is needed, for Home-Office and Furniture 26 euros, and for Consumer Electronics 33 euros.

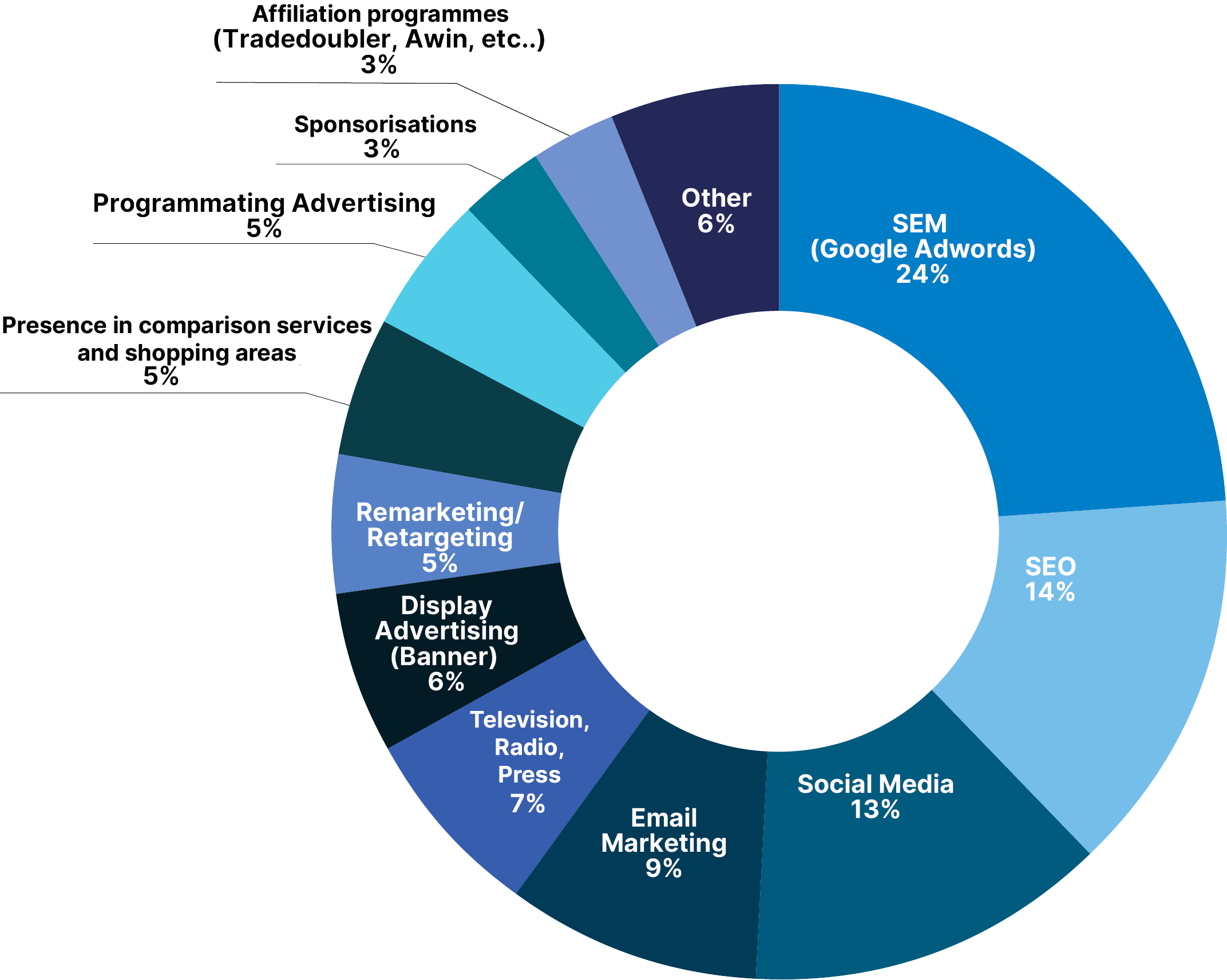

Among the marketing activities, SEM (Search Engine Marketing) continues to have the greatest investments (24%) with a higher increase than last year (19%). In second place with 14%, we find SEO (Search Engine Optimization). In third place, there is Social Media with 13%, followed by Email marketing with 9%, Display advertising with 6%, Comparison services with 5%, Remarketing and Retargeting with 5%.

Sponsorships drop two percentage points to 5%, Affiliation stays at 3% and Programmatic rises at 5%. A particular mention goes to TV, Radio and Press which after dropping from 13% to 5% last year, regain shares to 7%. However, by comparing data it can be noted that especially the companies declaring not to be satisfied with the results of the promotional strategy invest in traditional media.

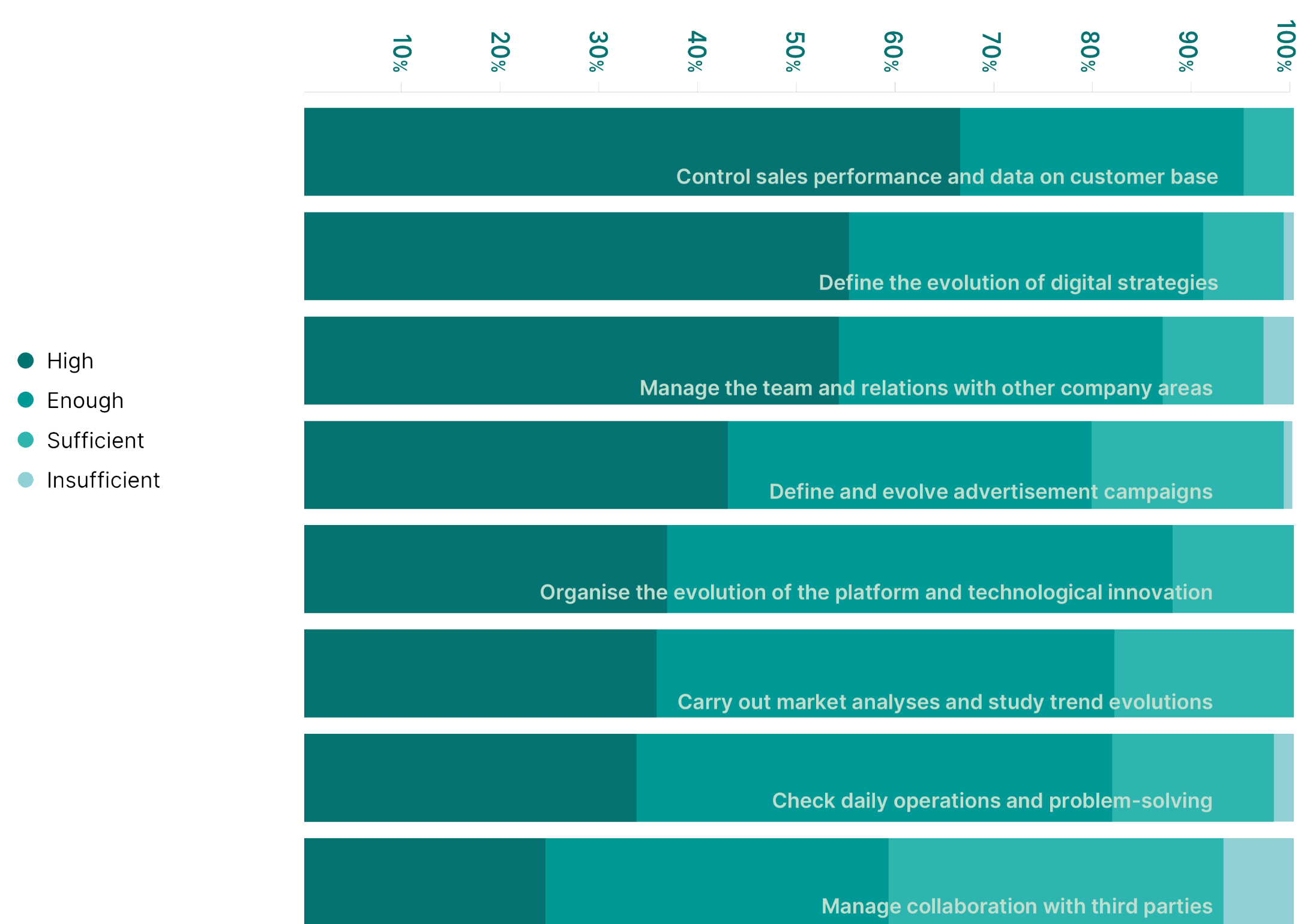

The main activities currently carried out by e-commerce managers are sales-oriented, such as monitoring sales performance and data on customer base (65% of e-commerce managers think it is very important), but include many other activities, such as defining the evolution of digital strategies (54%), managing their team and relations with other company areas (53%), defining and evolving advertisement campaigns (42%), organizing the evolution of the platform and technological innovation (36%), carrying out market

analyses and studying trend evolutions (35%), checking daily operations and problem-solving (33%), managing collaboration with third parties (24%).

With the increase in turnover and the internal importance of the e-commerce division in companies, in many cases, there have been organizational restructuring to better integrate digital activities into the rest of the company. At the same time, there has also been an increase in people in the team.

With over 147 million global active users and 2 million transactions per day, Klarna is meeting the changing demands of consumers by saving them time and money while helping them be informed and in control of their personal finances.

Commercetools is the world’s leading digital commerce platform that allows you to create powerful, highly customized commerce experiences while building a profitable, sustainable brand.

Marlene, the complete Livestream Shopping solution for eCommerce leading the market in Italy.

Taxdoo, the automated and secure VAT solution for financial compliance in the e-commerce.

Stripe is a payments infrastructure for the internet.

Download the complete research

DownloadCA’s research is a collection on the topics of innovation, to consult and download.

Researches Archive

Read moreThe Casaleggio Associati's ranking of best online stores in Italy

Discover the interactive ranking

Discover more